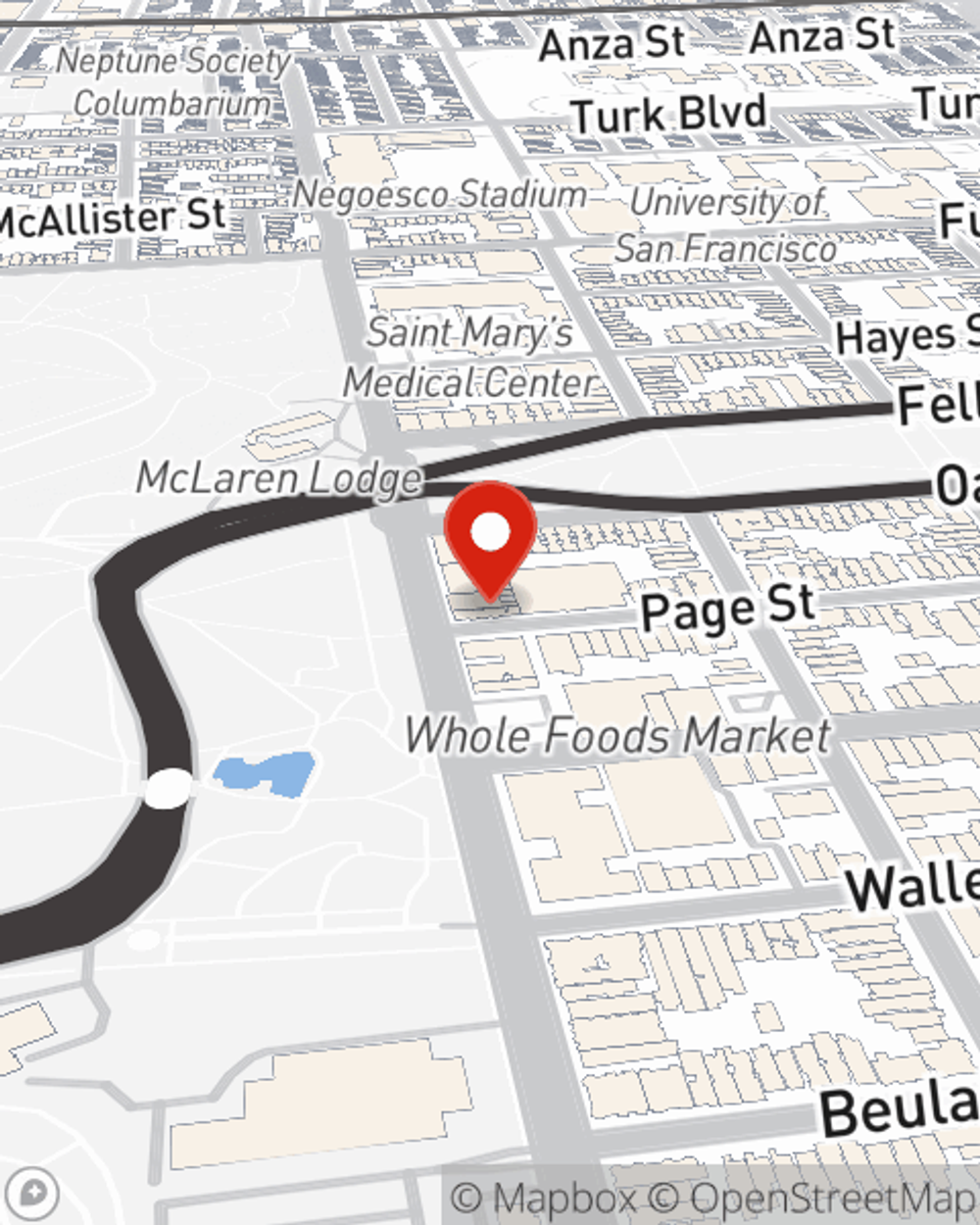

Business Insurance in and around San Francisco

Looking for small business insurance coverage?

Insure your business, intentionally

This Coverage Is Worth It.

Whether you own a a bakery, an antique store, or an art gallery, State Farm has small business protection that can help. That way, amid all the different decisions and moving pieces, you can focus on navigating the ups and downs of being a business owner.

Looking for small business insurance coverage?

Insure your business, intentionally

Protect Your Business With State Farm

Your small business is unique and faces specific challenges. Whether you are growing a shoe store or a refreshment stand, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Curtis Lee can help with worker's compensation for your employees as well as professional liability insurance.

As a small business owner as well, agent Curtis Lee understands that there is a lot on your plate. Call or email Curtis Lee today to talk over your options.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Curtis Lee

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.